Detailed Financial Review

Critical Accounting Policies

The Group's significant accounting policies are set out in Note 1 to the Group's Annual Report and Accounts.

Preparation of the consolidated financial statements requires Directors to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and accompanying notes. Actual outcomes could differ from those estimated.

The Directors believe that the accounting policies discussed below represent those which require the greatest exercise of judgement. The Directors have used their best judgement in determining the estimates and assumptions used in these areas but a different set of judgements could result in material changes to our reported results. The discussion below should be read in conjunction with the full statement of accounting policies, set out in Note 1 to the Group's Annual Report and Accounts.

Property, plant and equipment

Rental fleet accounts for £1,196 million, or around 94%, of the net book value of property, plant and equipment used in our business; the great majority of equipment in the rental fleet is depreciated on a straight-line basis to a residual value of zero over 8 years, although we do have some classes of non-power fleet which we depreciate over 10 years. The annual fleet depreciation charge of £222 million (2011: £175 million) relates to the estimated service lives allocated to each class of fleet asset. Asset lives are reviewed regularly and changed if necessary to reflect current thinking on their remaining lives in light of technological change, prospective economic utilisation and the physical condition of the assets.

Intangible assets

In accordance with IFRS 3 (revised) 'Business Combinations', goodwill arising on acquisition of assets and subsidiaries is capitalised and included in intangible assets. IFRS 3 (revised) also requires the identification of other acquired intangible assets. The techniques used to value these intangible assets are in line with internationally used models but do require the use of estimates and forecasts which may differ from actual outcomes. Future results are impacted by the amortisation period adopted for these items and, potentially, by any differences between forecast and actual outcomes related to individual intangible assets.

The amortisation charge for intangible assets in 2012 was £5 million (2011: £4 million). Substantially all of this charge relates to the amortisation of intangible assets arising from business combinations.

Goodwill of £143 million (2011: £65 million) is not amortised, but is tested annually for impairment and carried at cost less accumulated impairment losses. The impairment review calculations require the use of forecasts related to the future profitability and cash generating ability of the acquired assets. There were no impairment charges in 2012 and 2011.

Taxation

Aggreko's pre-exceptional effective tax charge of 26.0% is based on the profit for the year and tax rates in force at the balance sheet date. As well as corporation tax, Aggreko is subject to indirect taxes such as sales and employment taxes across various tax jurisdictions in the approximately 100 countries in which the Group operates. The varying nature and complexity of tax law requires the Group to review its tax positions and make appropriate judgements at the balance sheet date. In addition, the recognition of deferred tax assets is dependent upon an estimation of future taxable profits that will be available, against which deductible temporary differences can be utilised. In the event that actual taxable profits are different, such differences may impact the carrying value of such deferred tax assets in future periods. Further information, including a detailed tax reconciliation, is shown at Notes 10 and 22 to the Annual Report and Accounts.

Trade receivables

Trade receivables are recognised initially at fair value and subsequently measured at amortised cost. An impairment is recorded for the difference between the carrying amount and the recoverable amount where there is objective evidence that the Group may not be able to collect all amounts due. Significant financial difficulties of the debtor, probability that the debtor will enter bankruptcy or financial reorganisation and default, or large and old outstanding balances, particularly in countries where the legal system is not easily used to enforce recovery, are considered indicators that the trade receivable is impaired.

The majority of the contracts into which the Group enters are small relative to the size of the Group and, if a customer fails to pay a debt, this is dealt with in the normal course of business. However, some of the contracts the Group undertakes in developing countries are very large, and are in jurisdictions where payment practices can be unpredictable. The Group monitors the risk profile and debtor position of all such contracts regularly, and deploys a variety of techniques to mitigate the risks of delayed or non-payment; these include securing advance payments and guarantees. As a result of this rigorous approach to risk management, historically the Group has had a low level of bad debt write-offs. When a trade receivable is uncollectable it is written off against the provision for impairment of trade receivables. At 31 December 2012, the provision for impairment of trade receivables in the balance sheet was £63 million (2011: £36 million).

Currency Translation

The movement of exchange rates during the year decreased revenue and trading profit by £6 million and £1 million respectively as a result of currency movement. Currency translation also gave rise to a £58 million decrease in the value of net assets as a result of year-on-year movements in the exchange rates. Set out in the table below are the principal exchange rates which affect the Group's profits and net assets.

|

Per £ Sterling |

|

|

|

|

|

|

2012 |

2011 |

||

|

|

Average |

Year end |

Average |

Year end |

|

Principal exchange rates |

|

|

|

|

|

United States Dollar |

1.59 |

1.61 |

1.60 |

1.54 |

|

Euro |

1.23 |

1.22 |

1.15 |

1.19 |

|

Other operational exchange rates |

|

|

|

|

|

UAE Dirhams |

5.82 |

5.92 |

5.89 |

5.66 |

|

Australian Dollar |

1.53 |

1.55 |

1.55 |

1.52 |

|

Source: Bloomberg |

||||

Reconciliation of underlying growth to reported growth

The table below reconciles the reported and underlying revenue and trading profit growth rates:

|

|

|

Trading profit |

|

Revenue |

||

|

2011 |

1,396 |

338 |

|

Currency |

(6) |

(1) |

|

2011 pass-through fuel |

(108) |

(2) |

|

2012 pass-through fuel |

40 |

(1) |

|

Poit Energia acquisition |

33 |

3 |

|

Underlying growth including events |

228 |

44 |

|

2012 |

1,583 |

381 |

|

2011 revenue from Asian Games |

(6) |

|

|

2012 revenue from London Olympics |

60 |

|

|

As reported growth |

13% |

13% |

|

Underlying growth |

14% |

6% |

|

|

|

|

|

2010 |

1,230 |

312 |

|

Currency |

(26) |

(9) |

|

2010 pass-through fuel |

(74) |

(2) |

|

2011 pass-through fuel |

108 |

2 |

|

Underlying growth including events |

158 |

35 |

|

2011 |

1,396 |

338 |

|

2010 FIFA World Cup, Asian Games |

(87) |

|

|

2011 revenue from Asian Games |

6 |

|

|

As reported growth |

14% |

8% |

|

Underlying growth |

22% |

26% |

Exceptional items

The definition of exceptional items is contained within Note 1 of the 2012 Annual Report and Accounts. An exceptional credit of £7 million before tax was recorded in the year to 31 December 2012 in respect of the Group's acquisition of Poit Energia and costs associated with the recent Group reorganisation. There are three elements to the net exceptional credit. The first element is an exceptional credit relating to the release of £17 million of the £20 million deferred consideration relating to the Poit Energia acquisition earn out period. We completed the acquisition and the legal merger of the two businesses earlier than we anticipated and, accordingly we agreed with the Vendors that we would terminate the earn out period early in return for a payment of £3 million of the possible £20 million. Secondly, and partially offsetting this credit, there are £4 million of integration costs incurred to date for the Poit Energia acquisition. Thirdly there are £6 million of costs relating to the Group reorganisation. These costs include professional fees, severance costs, relocation costs and travel/expenses directly related to the reorganisation.

Interest

The net interest charge was £25 million, an increase of £7 million on 2011, reflecting the higher level of average net debt. This was mainly as a consequence of increased levels of capital expenditure, the Poit Energia acquisition and higher levels of working capital in our Power Projects business. Interest cover, measured against rolling 12-month EBITDA, remains very strong at 25.3 times (2011: 28.4 times).

Taxation

Tax strategy

Our tax strategy, which is applicable to all taxes, both direct and indirect, is to pay the appropriate amount of tax in each country where we operate, whilst ensuring that we respect the applicable tax legislation and take advantage, where appropriate, of any legislative reliefs available.

Responsibility for tax policy and risk management sits with our Chief Financial Officer including the role of Senior Accounting Officer (SAO) where we ensure as a Group that our systems are appropriate for the purposes of calculating the Group's UK tax liabilities.

Our tax strategy is aligned with the Group's business strategy and is reviewed and endorsed by the Board. In addition, the profile of our tax risk is reviewed on a regular basis. The tax strategy is executed by a global team of tax professionals who are integrated into our business and who are based in a variety of locations across the world where they work closely with the Aggreko operations, local tax authorities and local advisors.

Given the varied nature of the tax environment in many of the 100 countries in which we operate, local compliance is a key area of focus for Aggreko. This is particularly so for our Power Projects business, where we will generally only be in a country for a relatively short period of time. The complexity and often uncertain nature of tax rules in certain countries means we seek to manage compliance proactively by engaging with local tax authorities and advisors as appropriate, to agree and confirm our tax positions in a timely manner.

We recognise the importance of tax receipts to the countries in which we do business and as such we aim to be transparent with our stakeholders in terms of the geographic spread of where we pay tax.

Total taxes

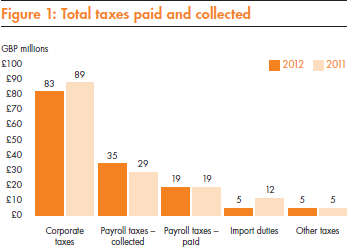

In 2012, Aggreko's worldwide operations resulted in direct and indirect taxes of £147 million (2011: £154 million) being paid to tax authorities. This amount represents all corporate taxes paid on operations, payroll taxes paid and collected, import duties and miscellaneous other local taxes.

The breakdown of the £147 million by type of tax is shown in figure 1.

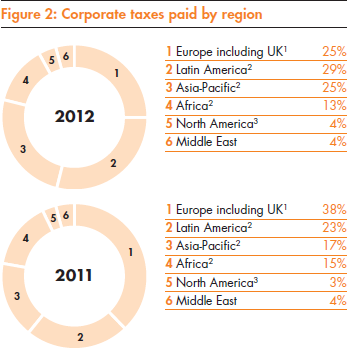

Figure 2 shows where the £83 million (£89 million in 2011) corporate tax was paid broken down by region.

| 1 | Our Power Projects business is operated via a UK company. |

| 2 | Latin America, Africa and Asia-Pacific combined represent the International Local and Power Projects segments of our business in these geographies. |

| 3 | North American taxes paid reflect accelerated tax allowances on capital investment. |

The most significant changes in the regional split of corporate tax paid year-on-year are: the reduction in the proportion of taxes paid in Europe, primarily due to the reduction in UK tax paid on Power Projects business activities, following the branch profits election; and an increase in corporate tax paid in both Asia (£6 million increase on 2011) and Latin America (£5 million increase on 2011), as our businesses in both these areas have grown.

Tax charge

The Group's pre-exceptional effective corporation tax rate for the year was 26.0% (2011: 28.5%) based on a tax charge of £94 million (2011: £92 million) on profit before taxation of £360 million (2011: £324 million). The change in the effective rate from 2011 to 2012 mainly resulted from the combination of the impact of the branch profits election on the Power Projects business and the mix of profits across operating territories. In terms of the branch profits election, the UK Finance Act 2011 introduced legislation exempting the profits of foreign branches of UK resident companies from UK corporation tax. With effect from 1 January 2012 this is applicable to a significant portion of our Power Projects business.

Further information, including a detailed tax reconciliation of the current year tax charge, is shown at Note 10 in the Annual Report and Accounts.

Reconciliation of income statement tax charge and cash tax paid

The Group's total cash taxes borne and collected was £147 million which differs from the tax charge reported in the income statement of £94 million. The income statement tax charge figure comprises corporate taxes only. These two figures are reconciled below:

|

|

£ million |

|

Cash taxes paid |

147 |

|

Non-corporate taxes |

(64) |

|

Corporate tax paid |

83 |

|

|

|

|

Movements in deferred tax |

17 |

|

Corporate tax movements through equity |

21 |

|

Payments in respect of other years |

(27) |

|

Tax charge pre-exceptional items |

94 |

Dividends

If the proposed final dividend of 15.63 pence is approved by shareholders, it will result in a full year dividend of 23.91 pence (2011: 20.79 pence) per ordinary share, giving dividend cover, on a pre-exceptional basis, of 4.2 times (2011: 4.2 times).

Cashflow

The net cash inflow from operations during the year totalled £479 million (2011: £509 million). This funded capital expenditure of £440 million. This spend was made up of £415 million of fleet and £25 million of non fleet with 67% of the fleet investment supporting the continued expansion of our International business. Net debt at 31 December 2012 was £228 million higher than the previous year with the main drivers being the acquisition of Poit Energia in April 2012, and higher levels of both capital expenditure and working capital. As a result of the increase in net debt, gearing (net debt as a percentage of equity) at 31 December 2012 increased to 57% from 42% at 31 December 2011 while net debt to EBITDA increased to 0.9 times (2011: 0.7 times).

There was a £163 million working capital outflow in the year mainly driven by higher levels of activity across the business and an increase in working capital balances in our Power Projects business. In terms of the latter, the Power Projects business saw a 23 day increase in debtor days to 90 days, mainly caused by two countries where payments were slower than usual. In addition the Power Projects creditors balance was lower than the prior year driven by lower running on two contracts where Aggreko is responsible for fuel management. Our manufacturing operation also saw a reduction in creditors driven by decreasing activity levels in the last quarter.

Net Operating Assets

The net operating assets of the Group (including goodwill) at 31 December 2012 totalled £1,709 million, £355 million higher than 2011. The main components of net operating assets are:

|

£ million |

|

|

|

|

|

|

|

|

Movement |

|

|

|

2012 |

2011 |

Headline |

Constant currency1 |

|

Rental fleet |

1,196 |

1,015 |

18% |

23% |

|

Property and plant |

82 |

72 |

13% |

18% |

|

Inventory |

178 |

147 |

20% |

24% |

|

Net trade debtors |

293 |

264 |

11% |

17% |

| 1 | Constant currency takes account of the impact of translational exchange movements in respect of our businesses which operate in currency other than Sterling. |

A key measure of Aggreko's performance is the return (expressed as operating profit) generated from average net operating assets (ROCE). We calculate the average net operating assets for a period by taking the average of the net operating assets as at 1 January, 30 June and 31 December; this is the basis on which we report our calculations of ROCE. The average net operating assets in 2012 were £1,577 million, up 29% on 2011. In 2012, the ROCE decreased to 24.4% compared with 28.0% in 2011. This decrease was mainly due to lower margins and increased working capital in our Power Projects business, as well as the first year impact of the Poit Energia acquisition.

Acquisitions

On 16 April 2012, we completed the acquisition of the entire share capital of Companhia Brasileira de Locacoes ('Poit Energia'), a leading provider of temporary power solutions in South America. The initial transaction price of £138 million (R$404 million) was made up of £105 million consideration payable to the owners of Poit Energia, plus £33 million of debt to be paid off by Aggreko on behalf of Poit Energia. In addition to the initial transaction price of £138 million, there was a further amount of up to £20 million conditional on the business achieving stretching performance targets for the year to 31 December 2012. We completed the acquisition and the legal merger of the two businesses earlier than we anticipated and, accordingly, we agreed with the Vendors that we would terminate the earn out period early in return for a payment of £3 million of the possible £20 million.

The total purchase consideration for accounting purposes was £125 million comprising the £105 million cash consideration plus the deferred consideration of £20 million. The fair value of net assets acquired was £37 million resulting in goodwill of £88 million. For accounting purposes the £33 million of debt does not form part of the purchase consideration. During the year it was agreed that only £3 million would be paid out in relation to deferred consideration, the balance of £17 million has been taken as an exceptional credit through the income statement. The detailed acquisition note is contained in Note 29 in the Accounts.

Shareholders' Equity

Shareholders' equity increased by £164 million to £1,045 million, represented by the net assets of the Group of £1,638 million before net debt of £593 million. The movements in shareholders' equity are analysed in the table below:

|

Movements in shareholders' equity |

||

|

|

£ million |

£ million |

|

As at 1 January 2012 |

|

881 |

|

|

|

|

|

Profit for the financial year |

276 |

|

|

Dividend1 |

(58) |

|

|

Retained earnings |

|

218 |

|

New share capital subscribed |

|

3 |

|

Return of value to shareholders |

|

(2) |

|

Purchase of own shares held under trust |

|

(11) |

|

Credit in respect of employee |

|

14 |

|

Actuarial losses on retirement benefits |

|

(2) |

|

Currency translation difference |

|

(58) |

|

Movement in hedging reserve |

|

2 |

|

As at 31 December 2012 |

|

1,045 |

|

1 Reflects the final dividend for 2011 of 13.59 pence per share (2011: 12.35 pence) and the interim dividend for 2012 of 8.28 pence per share (2011: 7.20 pence) that were paid during the year. |

||

The £267 million of post-tax profit (pre-exceptional items) in the year represents a return of 26% on shareholders' equity (2011: 26%) which compares to a Group weighted average cost of capital of 8.9%.

Pensions

Pension arrangements for our employees vary depending on best practice and regulation in each country. The Group operates a defined benefit scheme for UK employees, which was closed to new employees joining the Group after 1 April 2002; most of the other schemes in operation around the world are varieties of defined contribution schemes. A formal valuation of the UK Defined Benefit Scheme was carried out at 31 December 2011. At the valuation date, based on the assumptions adopted, the market value of the Scheme's assets (excluding AVCs) was £59 million which was sufficient to cover 78% of the benefits that had accrued to members, after making allowances for future increases in earnings.

Under IAS 19: 'Employee Benefits', Aggreko has recognised a pre-tax pension deficit of £4 million at 31 December 2012 (2011:£6 million) which is determined using actuarial assumptions. The decrease in the pension deficit is a result of higher than expected returns achieved on Scheme assets over the year and the additional contributions made by the Company during the year over and above the cost of accrual of benefits. This has been partially offset by lower net interest rates used to value the liabilities. The Company paid £0.6 million in January 2012 under the previous Recovery Plan and £3.5 million in December 2012 in line with the Recovery Plan agreed for the Scheme following the actuarial valuation at 31 December 2011.

The main assumptions used in the IAS 19 valuation for the previous two years are shown in Note 27 of the Annual Report and Accounts. The sensitivities regarding these assumptions are shown in the table below.

|

Assumption |

Increase |

Deficit |

Income |

|

Rate of increase in salaries |

0.50% |

(1.9) |

(0.1) |

|

Rate of increase in |

0.50% |

(4.8) |

(0.4) |

|

Discount rate |

0.50% |

9.4 |

0.7 |

|

Inflation (0.5% increases |

0.50% |

(9.8) |

(0.8) |

|

Longevity |

1 year |

(1.8) |

(0.1) |

|

|

|

|

|

Capital Structure and Dividend Policy

The intention of Aggreko's strategy is to deliver long-term value to its shareholders whilst maintaining a balance sheet structure that safeguards the Group's financial position through economic cycles. From an ordinary dividend perspective our objective is to provide a progressive through cycle dividend recognising the inherent lack of visibility and potential volatility of our business.

Given the proven ability of the business to fund organic growth from operating cashflows, and the nature of our business model, we believe it is sensible to run the business with a modest amount of debt. We say 'modest' because we are strongly of the view that it is unwise to run a business which has high levels of operational gearing with high levels of financial gearing. Given the above considerations, we believe that a Net Debt to EBITDA ratio of around 1 times is appropriate for the Group over the longer term. Absent a major acquisition, or the requirement for an unusual level of fleet investment, this level gives us the ability to deal with the normal fluctuations in capital expenditure (which can be quite sharp: +/– £100 million in a year) and working capital, and is well within our covenants to lenders which stand at 3 times Net Debt to EBITDA.

At the end of 2012, Net Debt to EBITDA had increased to 0.9 times compared to 31 December 2011 when the ratio of Net Debt to EBITDA was 0.7 times.

With respect to our ordinary dividend policy, at the end of 2012 the dividend cover on a pre-exceptional basis was 4.2 times.

Treasury

The Group's operations expose it to a variety of financial risks that include liquidity, the effects of changes in foreign currency exchange rates, interest rates, and credit risk. The Group has a centralised treasury operation whose primary role is to ensure that adequate liquidity is available to meet the Group's funding requirements as they arise, and that financial risk arising from the Group's underlying operations is effectively identified and managed.

The treasury operations are conducted in accordance with policies and procedures approved by the Board and are reviewed annually. Financial instruments are only executed for hedging purposes, and transactions that are speculative in nature are expressly forbidden. Monthly reports are provided to senior management and treasury operations are subject to periodic internal and external review.

Liquidity and funding

The Group maintains sufficient facilities to meet its normal funding requirements over the medium term. At 31 December 2012, these facilities totalled £863 million in the form of committed bank facilities arranged on a bilateral basis with a number of international banks and private placement notes. US$100 million (£62 million) of private placement notes were issued during June 2012. In addition, during the year committed bank facilities of £154 million were arranged. The financial covenants attached to these facilities are that EBITDA should be no less than 4 times interest and net debt should be no more than 3 times EBITDA; at 31 December 2012, these stood at 25.3 times and 0.9 times respectively. The Group does not consider that these covenants are restrictive to its operations. The maturity profile of the borrowings is detailed in Note 18 in the Annual Report and Accounts. Since the year end £30 million of committed facilities have matured.

Net debt amounted to £593 million at 31 December 2012 and, at that date, un-drawn committed facilities were £294 million.

Interest rate risk

The Group's policy is to manage the exposure to interest rates by ensuring an appropriate balance of fixed and floating rates. The Group's primary funding is at floating rates through its bank facilities. In order to manage the associated interest rate risk, the Group uses interest rate swaps to vary the mix of fixed and floating rates. At 31 December 2012, £311 million of the net debt of £593 million was at fixed rates of interest resulting in a fixed to floating rate net debt ratio of 52:48 (2011: 71:29).

Foreign exchange risk

The Group is subject to currency exposure on the translation into Sterling of its net investments in overseas subsidiaries. In order to reduce the currency risk arising, the Group uses direct borrowings in the same currency as those investments. Group borrowings are predominantly drawn down in the principal currencies used by the Group, namely US Dollar, Canadian Dollar, Euro and Brazilian Reais.

The Group manages its currency flows to minimise foreign exchange risk arising on transactions denominated in foreign currencies and uses forward contracts and forward currency options, where appropriate, in order to hedge net currency flows.

Credit risk

Cash deposits and other financial instruments give rise to credit risk on amounts due from counterparties. The Group manages this risk by limiting the aggregate amounts and their duration depending on external credit ratings of the relevant counterparty. In the case of financial assets exposed to credit risk, the carrying amount in the balance sheet, net of any applicable provision for loss, represents the amount exposed to credit risk.

Insurance

The Group operates a policy of buying cover against the material risks which the business faces, where it is possible to purchase such cover on reasonable terms. Where this is not possible, or where the risks would not have a material impact on the Group as a whole, we self-insure.